What if the solution to your financial problems has nothing to do with money itself? And, instead is rooted in your money mindset and the way you think?

The theory behind personal finance and growing a nest egg is easy. Most people realize they need to budget and live below their means to create wealth.

Yet, many people struggle. They know what they need to do, but can’t. Some fail to take the first step towards getting what they want. Others begin, but get distracted or lose their motivation.

For most people, the path to financial freedom has more to do with their money mindset than their cash. While saving and managing money are important, your thoughts and feelings about money have a tremendous influence on the results you’re going to experience!

Taking the time to explore your own beliefs will help you find clarity and breakthrough mental barriers. This will allow you to move forward, so you can go on to reach greatness!

What Is A Money Mindset?

Your mind is a powerful tool. The thoughts you have about any situation becomes your reality. It gives you the ability to turn hardship into opportunity, pain into joy, and failure into success.

Your money mindset is your attitude towards money and your thoughts about how it works in the world. These beliefs drive your decisions and impact your point of view.

Your financial beliefs guide the choices that you make. They contribute to the way you spend, save, and manage your money. These ideas further influence your feelings on debt, what is enough money, and whether you should leave a legacy.

How do you view the rich? Many people think they’re materialistic, greedy, and self-centered. While this may be true for some, they’re also the most likely to give to charity. A 2018 US Trust Study of High Net Worth Philanthropy found that 90% of the wealthy gave to charity as compared to just 56% of the general population.

Your mindset and the stories you tell yourself play a key role in the results you get, too. Believing that you can achieve something increases the likelihood that you will!

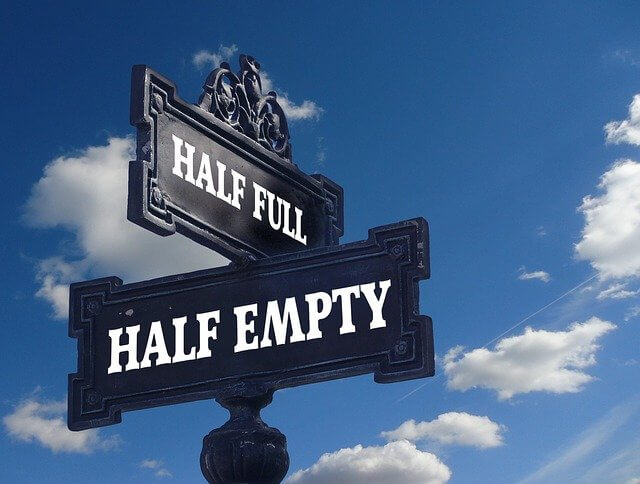

Exploring your money mindset allows you to get honest about your relationship with money. It develops awareness and helps you determine if you’re coming from a place of scarcity or abundance.

The Types Of Money Mindsets

Humans are emotional. The thoughts and feelings we have are a result of our surroundings and upbringing. Often, these experiences have a larger impact on us than we realize.

Most people begin developing their thoughts and feelings about money at a young age. While growing up, we learn by observing our parents and the ways money gets discussed.

As we get older, our friends, community, and marketing influences our thoughts. The combination of all these experiences leads to our money mindset.

Scarcity Money Mindset

One of the main reasons people struggle with money is due to their negative views towards it. They see it as something evil or bad, which holds them back and prevents them from prospering.

People that have a scarcity mindset often come from a place of lack. Most believe they won’t ever have enough money, things, or success.

Two of the biggest factors contributing to a scarcity money mindset are consumption and comparison. Often, these people believe they have to own certain products and keep up with the Joneses to be happy, successful, and accepted.

Many of these individuals blame their financial situation on outside influences, too. They fail to take responsibility for their actions or lack thereof. Sometimes, their problems seem so big that they end up ignoring them altogether. This leads to more headaches and can result in financial hardship.

Also, they’re unwilling to look at things from a different point of view. They think their situation won’t ever change, which can make them feel overwhelmed and defeated. Many procrastinate, too. They figure there’s no sense in trying since their problems are impossible to solve.

People that have a scarcity money mindset focus on the past. They’re usually stuck on their previous mistakes and how they should have done things. These thoughts keep them stuck in the old days and prevents them from moving forward.

Feeling stressed or anxious about money? No matter how bad you may feel or hopeless things may seem, all financial situations can be fixed. I can help you. Learn More And Get Your Financial Fix!

Abundance Money Mindset

A Ramsey Study of of over 10,000 millionaires found that 97% of them had a positive money mindset. They believed that they would become wealthy well before they ever did!.

Individuals with an abundance mindset focus on their goals. They realize that they can and need to take consistent small steps forward to get what they want.

But, these people also recognize that challenges and setbacks are a part of the journey to success. They know that they’ll need help along the way, yet they remain optimistic about their future.

These Individuals concentrate on growth, too. They’re committed to learning new skills, solving problems, and improving their financial wellbeing.

People with an abundance money mindset are positive. They believe in the power of change and the good that will result. These individuals realize that money is a tool and their dollars can make a difference. As a result, many choose to support a cause and invest sustainably.

When you have an abundance mindset you are in control of your thoughts and money. You commit to your budget, savings, and your plans for the future.

One of the key differences between a scarcity and abundance money mindset is gratitude. Those with negative beliefs tend to concentrate on what they don’t have and what’s missing. While positive people are more willing to give thanks and appreciate the things they have already.

What Is Your Money Mindset?

Money is a complex and personal subject. We all have our own thoughts and experiences with it. This is why you need to explore your money mindset.

Take a few minutes and consider the following questions. Make a note of your answers and the feelings that each one provokes.

- How much should you spend? Save? Give?

- How and when should you use debt?

- How do you value time? Money?

- What should you do with financial windfalls?

- How do you react to financial setbacks?

- What impact (positive and negative) is your money having on the world?

- What would you do with $1 million right now? Why?

If you’re like most people, you have at least a few negative beliefs about money. But, these thoughts can also help you. They can be used to identify challenges you may face while creating wealth. Spotting them early allows you to make changes quickly, which helps you to reach your dreams faster!

How To Change Your Money Mindset

When you focus on the past and your previous mistakes, you become stuck there. Reliving these negative experiences causes added suffering, which doesn’t help you progress.

Instead, concentrate on the here and now. What can you do right this second to start gaining forward momentum?

Success leaves clues and most high achievers set SMART financial goals. They develop a strong connection to their ‘why’ and are confident they’ll accomplish what they’ve set out to do.

These people review their progress along the way and know they’ll run into obstacles. But, they also realize these are opportunities that will lead to growth and help them achieve their dreams!

Also, practice an attitude of gratitude. An article from Harvard Medical School found that giving thanks can make you happier and more positive. This helps you focus on the things you have, your accomplishments, and all that you’re capable of!

I write about the benefits of being a tightwad. The steps you should take to live on less, save more, and reach your dreams faster. But, none of that matters if you don’t first believe it’s possible!

Your money mindset has everything to do with your thoughts and beliefs. But, nothing to do with the amount of money you make or your personal financial statement.

The first step in creating wealth and achieving your goals is believing that you can. Commit to an abundance money mindset and start building your future now!

What is your money mindset?

Leave a Reply