Management fees. Legal costs. Operating expenses.

Whether you realize it or not, investing can be expensive. Most of the assets that you buy have a wide variety of costs that can add up fast which drags down your rate of return!

Even most of the mutual funds and other equity investments in your 401K have high fees. Their expenses may appear as a small percentage, but is based on an ever growing dollar amount as your portfolio grows and you contribute more money!

As an investor, you’re planning for the future and investing for the long term. However, these fees that you pay as part of an investment’s total expense ratio will affect your finances. Not only do they impact your investment returns, but they also progress towards your most important financial goals, too!

What Is A Total Expense Ratio?

Investment funds are expensive. They require large start-up, legal, and ongoing payroll costs to operate.

The total expense ratio is the percentage of an investment funds’ (ie. mutual fund) expenses relative to the assets it manages. It shows the portion of investment capital that goes to the operation of the fund.

This is a mandatory metric that’s published by all US investment funds. The Security and Exchange Commission (SEC) regulates it and requires it to be as clear and concise as possible.

The total expense ratio consists of management, administrative, and advertising fees. They can range from a few basis points (ie. .03%) to over 2%!

These fees get paid regardless of how the fund performs. No matter if the investment goes up, down, or sideways, it still costs and bills that have to get paid.

The expenses that a fund pays reduces the profit that it makes, like in your budget. This in turn decreases the returns that investors receive.

For example, imagine you invested in the BigFee Mutual Fund and it makes an 8% return. But, it also has a 2% total expense ratio, which reduces your net gain down to 6%!

This metric doesn’t account for the transaction costs, either. The more often a fund trades, the more they pay in fees, further reducing your profits!

Why Do You Pay Investment Fees?

It’s time consuming and a lot of work to launch an investment fund. They have many moving parts, all of which need money to function.

Actively managed funds have the highest total expense ratios. They incur the costs of marketing, conducting research, and retaining key personnel with golden handcuffs.

The largest fee in the total expense ratio goes to paying the fund manager. This individual or group is in charge of the fund. They use their expertise to buy and sell securities. Their goal is to generate good returns that are higher than the general stock market.

Many investors look at these professional money managers as superhuman. They believe these managers have special insights and are worth the large fees they charge. These shareholders assume that by paying high management fees, they’ll earn above-market returns.

How Do Actively Managed Funds Perform?

According to an article on CNBC, actively managed funds struggle over the long term. Their research indicates that over the last 10 years, 85% of large-cap funds under performed the S&P 500. Also, almost 92% lagged behind the index after 15 years!

Based on this article, only 8% of fund managers can outperform the market. This number decreases even further as time progresses. This means there’s a very small chance that you’ll be able to pick the right manager. Odds that I don’t like for you or your money!

More often than not, fund managers are not fortune-tellers. They can’t predict the future or beat the market. If they could, they’d do it on their own and wouldn’t charge outrageous fees to under perform the market!

How The Total Expense Ratio Affects You

Wall Street wants you to believe they can beat the market. That way you’ll buy their investment products and they’ll continue to make billions of dollars each year off everyone that does!

According to ICI.org, mutual funds manage over $22 trillion in assets. Investopedia estimates their average total expense ratio is between 0.5% and 1.0%. On the low side, they make $110 billion in fees each year!

The higher your total expense ratio, the more of your investment capital goes to overhead. It reduces your returns and the principal amount you have to invest. These costs further limit the power of compounding, which makes you work longer and save more to reach financial freedom!

How To Reduce Your Total Expense Ratio

Most actively managed funds aren’t worth all the fees they charge. The vast majority of them can’t beat the market and they’re a drag on your good returns.

There’s a better option, one that doesn’t involve as many fees! The solution, passively managed funds!

These products are simple and have a low total expense ratio. They’re easy to understand because they track an index, like the S&P 500 or Russell 2000.

Passively managed funds invest according to the index they follow. This eliminates the need to conduct research, trade, and pay expensive managers!

The two main types of passively managed funds are Exchange Traded Funds (ETFs) and index funds. They both track a particular index and the main difference is that ETFs can be traded more easily.

Passively managed funds have the lowest total expense ratio in the industry. Many offered by Vanguard, Fidelity, and Schwab have ones that are less than .05%!

This means that for every $1,000 you invest, you pay only $.50 in fees. Passively managed index funds are ultra low cost and efficient, making them Tightwad Todd approved!

Financial Impacts of the Total Expense Ratio

Over time, Investment fees add up. They reduce the principal amount you have invested and lower your return on investment. Limiting these costs will help you earn higher returns and reach your financial goals faster!

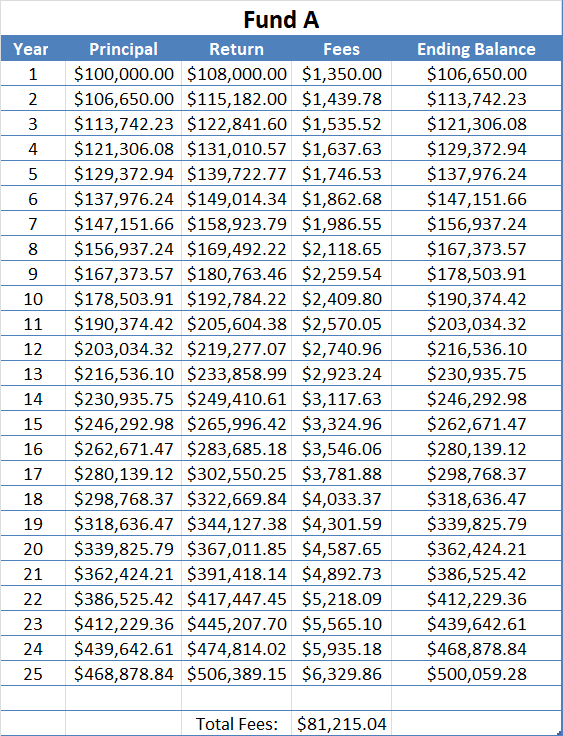

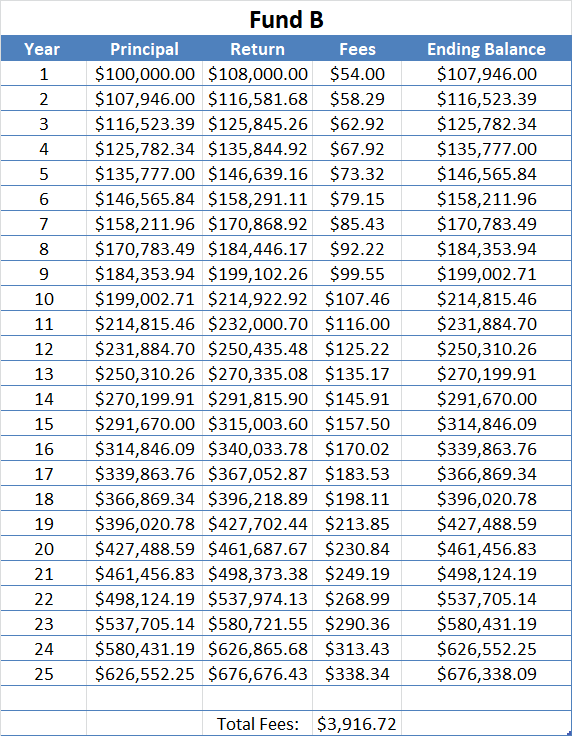

For example, imagine you’re 25 years from retirement and you have $100,000. You have the option of investing in Fund A or Fund B. Fund A has a total expense ratio of 1.25%, while Fund B’s is 0.05%. They both will earn 8% per year. What happens to the fees and balances over time?

At the end of 25 years, you would have paid $81,215 in fees in Fund A, while only $3,916 in Fund B. That’s a difference of $77,299! Also, Fund B’s lower total expense ratio results in a higher investable principal balance each period. This means there is a larger balance that compounds every year. At the end of 25 years, Fund B has over $176,000 more than Fund A!

Fund A would need to outperform the market to achieve the same returns as Fund B. It would need to earn 9.313% per year for the next 25 years. That’s beating the market by over 16% every year!

How To Check Your Total Expense Ratio

- Financial Regulatory Authority’s Fund Analyzer Tool

- NerdWallet’s Analyze Your 401k Fees

- Personal Capital’s Hidden Fees Tool

- TD Ameritrade’s Mutual Fund Comparison Tool

As an investor, you pay fees every time you buy an asset. These costs can add up to tens or hundreds of thousands of dollars over your lifetime. The price you pay affects how hard your money works for you and how you’ll end up spending your time.

But, you don’t have to. There’s no need to believe the hype surrounding actively managed funds!

You have the power to buy investments that have a low total expense ratio. These assets will help boost your return, keep more of your principal, and achieve your dreams faster!

Check your investment’s total expense ratio.

How much will you pay in investment fees? Comment below.

Leave a Reply