Exhilaration! Thrill! Excitement!

When it comes to investing, these are common emotions you experience from receiving financial gains. You took the time to set up a budget, save, and invest; now, it’s paying off and it’s exciting!

However, it’s important to realize that not all financial gains are the same. In fact, there are differences and can get broken down into two main types; realized and unrealized gains.

Understanding the difference between these two allows you to make smarter decisions. Ones that not only can reduce your tax burden but also allow you to create wealth and achieve your financial goals, faster!

What Are Realized Financial Gains?

As an investor, you buy assets with the expectation that they’ll increase in value. The amount that they rise above your purchase price is your profit or financial gain.

Financial gains get measured in terms of dollars. They’re calculated by taking the difference between the amount you paid and the amount you would receive from selling the asset today.

Once you’ve sold an asset, the financial gain is realized. The profits you’ve made off your investment now become a part of your income and are subject to tax.

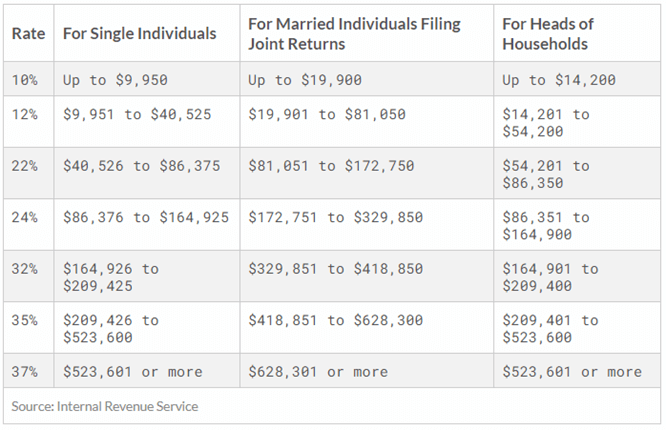

Realized gains are subject to capital gains tax. The amount you’ll pay gets based on your tax bracket and length of ownership.

Short Term Capital Gains

The profits that are made on assets that are bought and sold within one year are called short-term gains. They’re taxed according to your highest ordinary income tax bracket but are not subject to Social Security or Medicare taxes.

For example, imagine you’re married, file jointly, and expect to make $100,000 this year as a couple. Your income puts you in a 22% marginal tax bracket which means you’ll pay taxes of at least that same percentage on your short-term financial gains. But, if you have an exceptionally good year with a large amount of short-term gains, then it’s possible that you could end up in a higher bracket.

Long Term Capital Gains

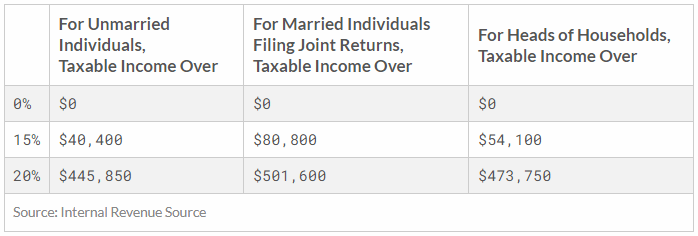

The income you earn from assets that you buy and hold for a year or longer are considered long-term gains. They’re looked at more favorably by the IRS and fortunately for you they’re taxed at lower rates.

Case in point, imagine again that you’re married, file jointly, and expect to make $100,000 this year as a couple. The assets you’ve owned for a year or longer get taxed at a lower rate. Instead of paying 22%, you’d pay 15% and have a 7% savings!

When you sell an asset you lock in your financial gains. This removes any possibility that it will further increase or decrease in value.

Yet, in most cases, once you realize a financial gain, you’ll want to reinvest your capital. By doing this, your money continues growing and working towards your plans for the future!

Unrealized Financial Gains

Unrealized gains (aka paper profits) only exist on paper. They occur when you’ve bought an asset that’s gone up in value, but you haven’t sold it yet. Since there hasn’t been a sale, no gains get realized, and therefore no taxes are due.

Paper profits are based on a snapshot in time. They’re calculated at one specific moment. Until you sell, your gains are likely to fluctuate.

For instance, imagine you bought a stock for $10 per share and a year later it’s worth $15. At this point, you’ve made an unrealized financial gain of $5 per share. Now, you’re faced with the choice of realizing the gain or continuing to hold the stock.

There are many reasons investors choose not to realize their financial gains. Two of the most common ones are that they may believe that the asset’s value will increase further or they’ll be able to reduce their tax burden by holding on to it longer.

In some situations, it makes sense to keep assets just to avoid paying short-term capital gains tax rates. This is especially the case if you have a high ordinary income tax rate. It can also be a smart money move to delay selling if you expect your income will fall in the following tax year, too.

The Effect of Taxes on Financial Gains

The main decision you face on whether you should realize your financial gain or not has to do with future risk and taxes. While there are some ways to reduce your risk, there isn’t a way to avoid paying your legal share of taxes.

Active investors, those who buy and sell assets, pay more taxes than those who buy and hold. Over time, this reduces the power of compounding and ultimately delays the achievement of their goals!

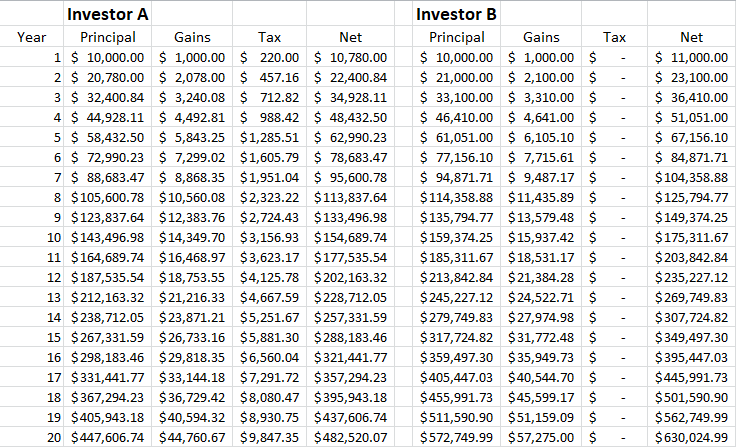

To illustrate, imagine there are two different investors. Investor A is an active investor who pays short-term capital gains tax and Investor B is a passive investor who holds their assets long term.

Let’s assume that each will earn a 10% rate of return, be in a 22% tax bracket, and invest $10,000 per year. How does this play out over the next 20 years?

At the end of 20 years, the buy-and-hold investor has almost $150,000 more than the trader. To make up for this shortfall, the trader would have to earn over a 12.8% return each year for 20 years in a row! They would need to outperform the market by 28% every year to have the same amount as the buy-and-hold investor. This is an accomplishment that very few financial professionals could do, let alone the average DIY investor!

Most people pursuing financial freedom are long-term investors. They’ve come to realize that buying and selling assets are subject to higher taxes and that it’s difficult to consistently beat the market. Instead, they’ve found that buying and holding passively managed index funds is a better option.

How to Increase Your Financial Gains

It’s important to remember that a financial gain measures the dollar amount of profit that your investment makes. Therefore, the more money that you save and put towards your investments, the larger your gains will be!

Here are 7 ways you can produce larger financial gains:

- Lower your monthly expenses

- Stick to a budget

- Increase your income

- Control lifestyle creep

- Find the best use of your money

- Use retirement accounts to grow your nest egg

- Invest for the long term

Watching asset prices go up and experiencing financial gain is exciting! It helps you see progress as you edge closer to your goals and dreams. But, it’s also important to realize this calculation is just one metric you should consider and doesn’t show you the full picture.

For example, would you get excited over a $5,000 gain? What if it took 5 years and required a $50,000 investment to earn it? Would you still be as excited?

Unfortunately, a financial gain doesn’t consider the amount of time or money that’s needed to generate it. Nor does it account for your money personality and the amount of risk that you’re comfortable taking.

Still, you should calculate and be aware of your financial gains. They’ll help you recognize forward progress and plan ahead so that you can save money on one of your largest expenses – taxes!

What’s the largest financial gain you’ve ever earned? Comment below.

Leave a Reply