When it comes to investing, most people realize that there are advantages to owning investment real estate. Yet, many of them will never buy because they don’t want the headache of renting out properties, managing tenants, or dealing with problems!

Luckily, real estate syndications make it easy for everyone to invest in real estate. Instead of being time consuming and management-intensive, they allow you to be passive. In addition, they give you all the advantages that come from owning real estate, without having to do all the work that’s involved in operating them!

What are Real Estate Syndications?

Have you ever wondered who owns large apartment complexes, office buildings, and shopping centers? Unlike residential real estate where there’s usually one owner, these properties are often owned by an institution or a real estate syndication.

Real estate syndications are partnerships that are formed by a group of investors. These individuals come together where they’re able to pool their experience, expertise, and capital. As a result, the group can buy larger and more expensive properties than they would be able to afford on their own!

Syndication investments are made up of General Partners (aka GPs, syndicators, or sponsors) and Limited Partners (aka LPs, investors, or passives). The GPs are responsible for finding properties and evaluating them. Once they discover a property meeting their investment criteria, they’ll work to get it under contract.

After the syndicators go under contract, they’ll raise capital from individual investors for the purchase. Investors’ funds will get used for the down payment, closing costs, and for executing the business plan.

At closing, most real estate syndications form and take ownership of the property via an LLC or Corp. This way the GPs and LPs are both reducing their risk of personal liability, helping to protect their other assets in the event of a lawsuit.

Once closed, the sponsors take control of the property. At this point, they’re in charge of managing the asset and carrying out the business plan. Meanwhile, investors can sit back, relax, and watch as the plan comes to fruition!

How Do Real Estate Syndications Make Money?

Like all investors, those who invest in real estate syndications want to make money and earn a rate of return. To be successful in these investments, you first need to have a basic understanding of commercial real estate and its valuation.

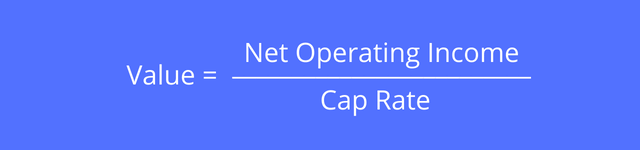

Commercial real estate is typically valued by its Capitalization Rate (Cap Rate). This rate gets set by the market and is divided by the subject property’s Net Operating Income (NOI) to determine its value.

For instance, if the going cap rate is 5% and the property produces an NOI of $50,000 then it would get valued at $1 million.

For instance, if the going cap rate is 5% and the property produces an NOI of $50,000 then it would get valued at $1 million.

As an investor, you make money on real estate syndications through the property’s cash flow and its appreciation. Cash flow is the difference between the property’s income and its monthly expenses. In personal finance terms, it’s the budgeting equivalent of savings. Appreciation is the difference between the property’s purchase price and the value when it’s sold.

Some operators prefer to buy properties strictly for the cash flow they generate while others want to add value and force the property’s appreciation.

Forced appreciation occurs when the sponsors increase the property’s net operating income. Like improving your savings ratio, this is done by reducing the property’s expenses, increasing its income, or through a combination of both.

For example, imagine during the evaluation process that the GPs discover a property that has a higher than normal burn rate. If they can sustainably cut the property’s recurring costs, then they’ll also increase its value. Similarly, if they find that the rents are below market, raising them would also boost the property’s value.

Typically, after a few months of ownership or as the property’s NOI grows, the GPs will begin a monthly or quarterly distribution of cash flows. At this point, the asset begins producing passive income for the investors and they’re making money without spending time!

While the NOI is somewhat within the syndicator’s circle of control, the Cap Rate is not. It depends on the market. As supply and demand fluctuate, so does the price that another buyer is willing to pay. If demand is increasing, then prices will rise. But if demand wanes, then prices will begin to fall

Besides NOI and the market, a host of other factors can also impact a property’s value. Changes in interest rates, population, building costs in addition to many others can affect the price between the time you buy and when you’re ready to realize a financial gain.

How the Syndicators Get Compensated

Like you, the sponsors don’t work for free. While you’re collecting mailbox money, they’re busy managing the asset, controlling costs, and executing the business plan.

Typically, syndicators make their money from distributions. They’ll receive a predetermined percentage of both the ongoing cash flow and proceeds from a refinance or sale.

For example, a real estate syndication may have an 80/20 split. This means that the passive investors will receive 80% of the distributions and the sponsors will get 20%. However, it’s important to note that the investors typically put up 80 – 100% of the capital while the syndicators contribute between 0 and 20%.

On top of distributions, many syndicators also make money by charging fees. Some charge acquisition, disposition, and asset management fees amongst many others. While these can be somewhat justified, they often add up to what seems like a large amount of money and they cut into your return on investment.

Most GPs are deserving of the fees they charge, too. Especially, given that the investment’s success hinges on their performance. But as an investor, it’s important to be aware of and comfortable with these fees before you invest in a real estate syndication.

Benefits of Real Estate Syndications for Passive Investors

Despite the costs, real estate syndications can offer many benefits to passive investors. Here are a few reasons why you may want to consider them:

- Passive Income

- No or low time commitment

- Stability – Large properties tend to be more stable than small ones

- Economies of scale

- Broader asset allocation

- Tax benefits via depreciation, especially for real estate professionals

- Easily invest in multiple cities

- Potential for an infinite rate of return

Potential Risks of Real Estate Syndications

All investments have risk and real estate syndications are no exception. In fact, given that they’re an alternative asset, most people have limited knowledge nor do they fully understand all of the risks that may be involved.

Before investing, you should have a solid grasp of commercial real estate and syndications. By understanding both, you’ll recognize some of the main risks you’ll face. A few of which include:

- General partner risk

- Property risk

- Market cycle risk

- Vacancy risk

- Inflation

- Interest rate risk

- Opportunity costs

- Changes in material and labor costs

- And many more!

Despite these risks, there’s no secret that real estate syndications can help you make large amounts of money, especially given the last few years. Still, that doesn’t mean you can take these risks for granted. Before investing, you need to do your due diligence. Be sure you’re comfortable with the sponsor, the property, and the long-term illiquid investment that you’ll be making!

How To Invest in Real Estate Syndications

Previously, real estate syndications were reserved only for the rich and wealthy. You had to have a high net worth as well as connections to have the opportunity to invest in them.

Today, many sponsors still require you to be accredited and have a relationship with them before investing. While this method still works, crowdsourcing is making it easier for everyone to participate in them!

Real Estate Syndication Crowdsourcing Platforms

Most of these platforms do charge fees on top of what the sponsor makes. With the additional costs, your total expense ratio grows and has the potential to drag down your profits.

However, one clear advantage these crowdfunding platforms have over traditional sponsors is that they have much lower investment minimums. Instead of having enough money to only invest in one deal, they allow you to spread your capital amongst many, reducing your overall risk in the process!

Questions To Consider Before Investing in Real Estate Syndications

- What are the sponsor’s background and track record?

- How comfortable are you with the location and the market?

- How much money are the sponsors investing?

- Is the business plan clear and achievable?

- How realistic are the sponsor’s projections?

- What’s the time horizon?

- How often will the sponsors communicate with the investors?

Like most areas in personal finance, there’s not a one size fits all reason to invest in real estate syndications. You may do it for another stream of income, diversification, or to learn how to become a sponsor yourself.

Regardless, it’s important to educate yourself further before investing. In doing so, you won’t just learn the ins and outs of real estate syndications, you’ll also discover how they can fit into your financial strategy and help achieve your long-term goals!

If you’ve invested in real estate syndications, what’s your experience been like? Comment below.

Leave a Reply