Granite countertops! Stainless steel appliances! Open floor plan!

For many people, purchasing a home is an emotional decision. They buy because it gives them feelings of accomplishment, a sense of pride, and a place to make their own.

Almost everyone gets told that buying a house is a smart investment. After all, housing almost always goes up in value. But, how accurate is this advice?

What Is An Investment?

According to Investopedia, an investment is an item that’s purchased with the goal of generating income or appreciation. While it’s possible to produce income from a home by renting out rooms or using Airbnb, it’s not the reason most people buy.

Assuming that home values will rise is a form of speculation. It’s a gamble and isn’t something that’s guaranteed. If the Great Recession and 2020 have taught us anything, it’s that nothing is certain!

Housing is an important topic. It’s the largest expense American households face. But, does that mean buying one is a smart investment?

The Costs of Home Ownership

To answer this question we have to consider all the expenses involved with owning a home. They are the holding, buying, and selling costs.

Holding Costs

Mortgage payments are the largest ongoing expense homeowners experience. According to the National Association of Realtors (NAR), 86% of buyers get a mortgage and most make a 12% down payment.

Data from the St Louis Fed reveals the median home purchase price is $327,100. Using the purchase price and down payment data, we determine the median loan amount is $287,848.

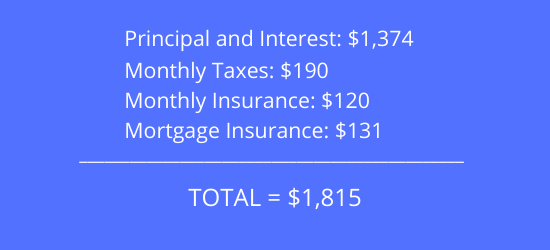

During this period, Bankrate shows that 30-year fixed interest rates hovered around 4%. Taking the loan balance of $287,848 and a 4% interest rate, we calculate the median principal and interest payments are $1,374.

Most homebuyers don’t make a full 20% down payment. They incur the added expense of mortgage insurance. Using a mortgage insurance calculator and median credit score of 706, reveals this cost is $131 per month.

Homeownership comes with property tax and insurance bills, too. Business Insider estimates the average property tax expense is $2,279. While Value Penguin approximates the cost of insurance is $1,445 per year.

Homeowners have an average monthly mortgage payment (also known as PITI) of $1,815.

More Home Ownership Costs

The cost of owning a home doesn’t stop with the payments, they’re just starting! Homeowners also need to plan for future repairs, replacements, and upgrades their home will need.

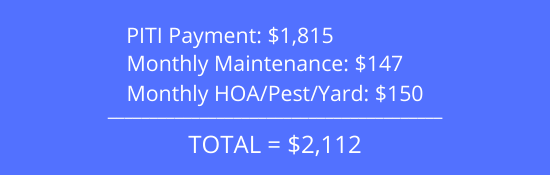

According to Bob Vila, a well-known home improvement expert, the average US home is 1,760 square feet. Most insurance companies recommend saving $1 per square foot per year for property-related expenses (a low figure in my opinion). This adds $1,760 to the cost of owning a home.

If I know one thing about owning real estate [link], it’s that things break…all the time. I’ve had to replace roofs, air conditioners, and even dry out flooded homes!

Also, consider the extra costs of yard work, pest control, and Home Owners Association (HOA) dues. These expenses vary based on the area, home, and how individuals choose to spend their time. For simplicity, we’ll assume these costs are $150 per month.

The average homeowner’s total monthly housing expense is $2,112!

Homeownership is expensive and can be a lot of work, which presents another question. Do you own your home or does it own you?

Increasing Ownership Costs

Above, we determined the housing payments with a 30 year fixed rate loan are $2,112 per month. But, these payments change and are not fixed for the entire life of the loan.

The principal and interest portion of the payment won’t change. But, the added expenses of homeownership will fluctuate every year. And by fluctuate, I mean increase!

Taxes, insurance, maintenance, and HOA/pest/yard costs rise due to inflation and rate hikes. To account for their increases, we’ll assume a compounding growth rate of 3%.

Lowering Home Ownership Costs

There is one piece of good news. The mortgage payments go down in year 2 because the monthly mortgage insurance (MI) can be removed!

MI is required on loans above 80% Loan to Value (LTV). This policy protects the lender if a borrower defaults on their payments.

Over the first two years, the home’s value increases, and the principal balance gets paid down. The combination of these allow a homeowner to request that their MI be removed. If they don’t, it drops off at 78% LTV.

Both of these LTV figures get based on the original purchase price, not the home’s current value. Therefore, most mortgage servicers will require a current appraisal to confirm the value of the home before the MI gets removed.

Total Holding Costs

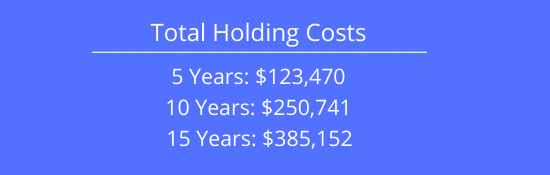

Homeowner’s experience many different expenses while they own and use their home. Their holding costs begin when they buy and end the day the home gets sold.

People move and sell their homes as their needs and wants change. The NAR determined that most people own their home for 13 years before they sell. While, many first time buyers trade up to a more expensive home after a few years.

Owner’s have different goals when they buy a home. Some are looking for a starter home, many want a place to raise a family, and others hope to make a smart investment. To account for all these differences, we’ll examine holding costs over 5, 10, and 15 years.

Home Buying Costs

Every investment you make has acquisition costs. In real estate, they are the down payment and closing costs.

A buyer spends $327,100 on their home and makes a 12% down payment. This equates to a $39,252 investment.

Closing costs vary throughout the United States. Usually, they’re 3% of the purchase price. Often, the buyer and seller agree to split them. Based on a $327,100 price, buyers can expect to pay $4,906 in closing costs.

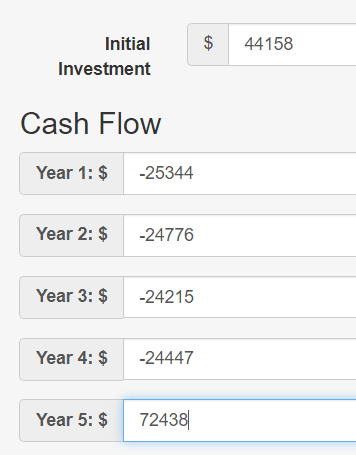

The average homeowner makes a $44,158 total investment when they choose to purchase a home!

Home Selling Costs

A homeowner incurs costs when they sell, too. These expenses are even bigger than the ones they paid as buyers. The selling costs increase because most owners hire a professional and their home’s value appreciates.

According to NAR, 89% of sellers use a real estate agent to sell their home. Realtors earn a 6% commission that gets paid by the seller.

Home Value Appreciation

Sellers pay more than realtor fees, they also incur larger closing costs. These expenses grow because they’re based on appreciation and the property’s future value.

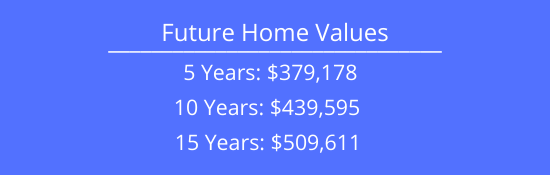

The Case Shiller Index is one of the best measures of home value appreciation. Shiller, in Case Shiller, publishes housing information dating back to 1890. This data reveals the historic annual growth rate of residential real estate is 2.7%.

While investigating if a home is a smart investment, we’ll assume a growth rate of 3%.

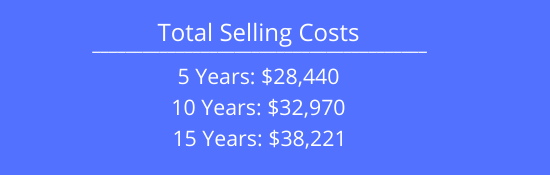

In total, a seller pays 7.5% of the sales price in commissions (6%) and closing costs (1.5%). The total selling costs for each holding period are:

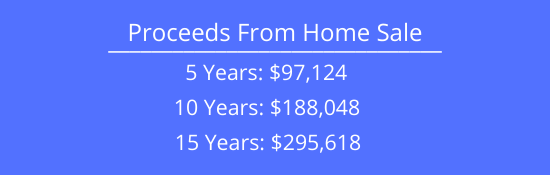

Proceeds From Home Sale

In the previous sections, we calculated the costs involved in owning, buying, and selling a home. To determine if a home is a smart investment, we need to know the amount a seller receives from their sale.

When a homeowner sells, they receive the majority of the equity in their home. Equity is the difference between the selling price and the mortgage balance. This amount gets reduced by the selling costs and the amount that’s left is the seller’s proceeds.

Is Your House A Smart Investment?

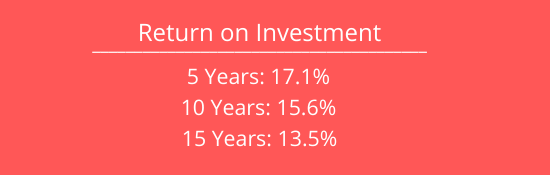

Many people that calculate investment returns look at the amount they invest and the amount they receive from the sale. This reveals the following return on investment:

But, this method is flawed! It only takes into account capital gains.

There are two components that makeup investment returns. They are capital gains AND cash flows.

For example, imagine you own a dividend-paying stock. Your return gets calculated using both the dividends (cash flow) and the capital gains you receive. Likewise, when viewing a home as a smart investment, the holding costs (negative cash flow) must be included, too.

An Internal Rate of Return (IRR) calculator gets used to measure an investment’s performance. It takes into account both the cash flows and capital gains. This information gets entered into the calculator as follows:

***Please note that in Year 5 the seller Nets $97,124 from the sale. They would have also paid $24,686 in holding costs, reducing their true net to $72,438.

Then, this calculation gets repeated for both the 10 and 15 year hold times.

The final results for determining if buying a house is a smart investment are (drum roll please)…

Every holding period yields a negative investment return!

Should You Buy A Home?

Homeownership is a big responsibility. You commit two of your most important resources to it, your time and your money.

If you decide you want to buy a home, understand your needs first. Then, buy based on how the payments will fit into your budget and lifestyle.

Don’t buy a home based on the largest amount a bank says you can afford. Avoid purchasing one that you think you deserve and don’t let lifestyle creep trick you into buying a bigger one than you need.

Many people fall into the trap of buying a more expensive home than they should. They believe spending more means they’re making a bigger and smarter investment. When in fact, they end up with a larger monthly housing expense and negative investment returns!

I am not saying that you shouldn’t buy a house. I own the one I live in and can still remember how great it felt the first time I received the keys and pulled into MY driveway.

But, we must remember the primary function of a home is to meet one of our most basic needs, shelter. While the purpose of investing is to make money.

A home isn’t a smart investment because it doesn’t provide income or net positive appreciation.

When you choose to buy a home you are not making an investment decision. But, rather one that’s based on consumption and your wants.

Is your house a smart investment or your biggest liability? Comment below.

Leave a Reply