Disclaimer: I am not a CPA. The information contained on this website is for informational purposes only and is not actual accounting advice. Be sure to contact your accountant before you take any action.

If you are like most Americans, you spend the majority of your day at work. You put in long and hard hours for your pay. And in many instances, before the money even makes it to your account, the IRS takes out a portion as taxes.

Income is defined as the money you receive in exchange for goods or services. But, it’s important to realize that not all earnings are created equal, nor are they taxed the same either!

There are 3 main income types. All originate from different sources. Knowing the difference between each and how they get taxed can save you $1,000s!

Taxes are one of your largest expenses. Anything you do to reduce them will have an enormous impact on your finances. And propel you forward towards your goals!

Type 1 – Active Income

The most common type of income is active or ordinary income. It’s so appropriately named because it requires YOU to be actively involved to earn it. This is the income you receive as a contract employee, small business owner, or from a job. You are trading your time for money when you receive active income.

Ordinary income is taxed at the highest rates. Which is good for Uncle Sam, but bad for your wallet.

Your pay is taxed on a progressive scale. The more you make, the more you pay. Also, you are required to pay both Social Security and Medicare taxes on it!

Most people are taught from a young age to go to school and get good grades. Which hopefully results in a high paying job. This approach is a good way to earn a living. But it’s the best at guaranteeing you pay high taxes!

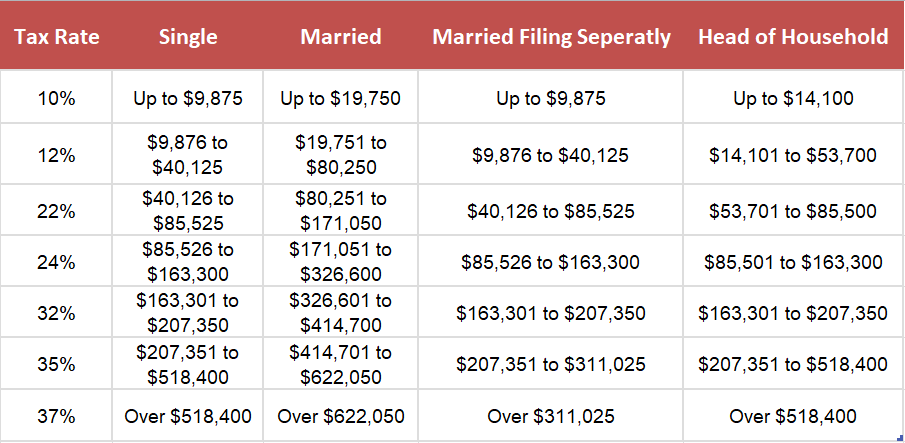

Take a look at the current tax rates for 2020, which do not include Social Security or Medicare Taxes.

Type 2 – Portfolio Income

These earnings are generated from paper assets, like stocks and bonds. When securities are bought low and sold high, they result in a profit. Which is also known as a capital gain.

Tax rates on capital gains are based on your length of ownership. They are broken down into short term and long term.

Short term capital gains come from assets that are held 365 days or less. They get taxed at the same high rates as active income. Up to 37% depending on your income level!

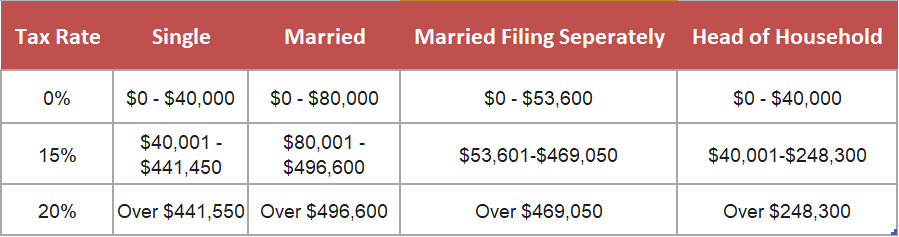

Long term capital gains come from investment vehicles that are held for over 365 days. They are taxed at lower rates, with the maximum being just 20%. What a huge difference one day can make!

Short term capital gains are taxed at the same rate as active income. Refer to the previous graphic for their tax rates.

Unlike active income, portfolio income is not subject to Social Security or Medicare taxes!

The current tax rates for long term capital gains are:

Type 3 – Passive Income

The third type of income gets earned from assets you own but don’t materially participate in. Two examples are the cash flow from real estate or the profits from a business you own but don’t materially participate in.

What is Material Participation?

It’s an IRS test to determine if you participated in a business or not. This test determines the number of hours you can work in a business before you qualify as materially participating. And once you pass the threshold, you get taxed at active income rates. As always, it is best to speak with your CPA about your circumstances.

Passive income is the most tax-advantaged type of income that exists! And like portfolio income, you don’t pay Social Security or Medicare taxes on it.

The IRS even has special sections in the tax codes for this income type. Two examples are depreciation and depletion. Both of which allow the taxpayer to take a paper loss on an asset.

Depreciation is a tax deduction on investment real estate. It comes from the reduction in the useful life of a property due to aging, wear, and tear. And the IRS allows owners to write off part of its value each year.

Depletion is a tax deduction that occurs when a resource gets consumed over time. Such as oil getting pumped out of an oil field.

Passive income gets taxed at the same rates as portfolio income. Refer to the previous graphic for its tax rates.

Out of all the income types, passive is my favorite. It has the most tax benefits. And it requires less of your time to earn than active income!

Comparing Income Types

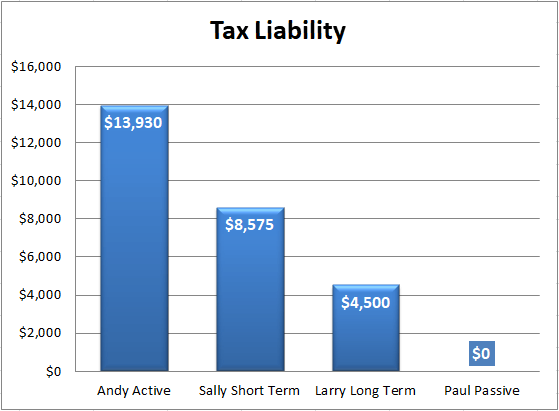

The easiest way to understand the different income types is by looking at an example. Let’s assume we have 4 earners; Andy Active, Sally Short Term, Larry Long Term, and Paul Passive. Each earns $70,000.

For simplicity, assume they all are single with no dependents. They do not contribute to a 401k and do not take any deductions. We also need to assume that Paul owns a $1 million apartment building with $36,363 in yearly depreciation. Take a look to see how much each pays in taxes.

You can see that Andy Active pays the most in taxes because he has active income. And it gets taxed the highest! While Paul pays the least because he is a passive income earner.

How did Paul pay so little?

Yes, he made $70,000 just like everyone else. But his taxable income gets reduced to $33,637 due to depreciation. And since he makes passive income, he gets taxed at the long term capital gains rate, 0%!

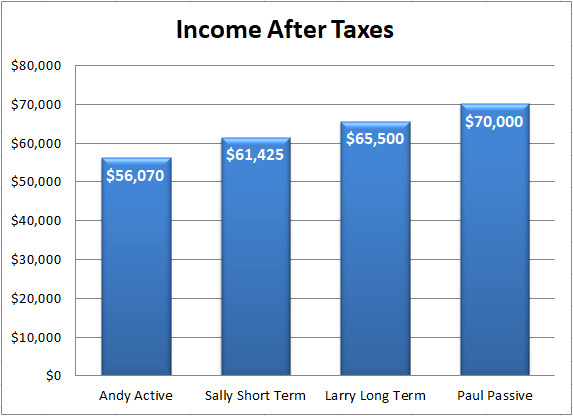

When it comes to money, it’s NOT about how much you make. It’s about how much you get to keep! Here is what their after-tax incomes look like:

What a huge difference your income source makes when paying taxes. And determining the amount of money you get to keep!

The government rewards people who have portfolio and passive income. They give them lower tax rates.

Investing in businesses creates jobs for others. Which allows the government to tax the new jobs at active income rates. The highest tax rates that exist!

After reviewing these three income types, it’s time for you to re-think the kind of money you are working for. Active income will always require YOU and YOUR time. While portfolio and passive income only need your investment.

Taxes are a huge part of your yearly expenses. And by creating a long term portfolio and passive income stream, they will be reduced. These two income types keep more money in your pocket. Saving you time on the path to accomplishing your goals!

Which type of income are you focused on earning? Comment below.

Leave a Reply