Looking back over the last few years, was there a surprising silver lining to the Corona Virus Pandemic?

Oddly enough, the US savings rate hit its highest level ever in April 2020. American’s have raised the bar and are saving more than ever before!

Businesses have restricted hours. Consumers are spending more time in their houses. And money is finding a new place to call home, primarily in bank accounts!

Now that you have extra cash, what should you do with it?

Here are the 10 best money moves you can make today with $1,000 or less.

#1 – Your Emergency Fund

Preparing for your financial future starts with planning for the unexpected. Your emergency fund is there to help you through life’s surprises.

If you don’t already have an emergency fund, use your $1,000 to start one. Open a high yielding savings account and deposit this money into it. Let your money sit and grow through the power of compounding interest.

Continue making deposits until you have at least 4-6 months of your living expenses set aside. Then don’t touch it. Simply wait and prepare to be shocked at what you end up spending it on!

Adding an extra $1,000 to your emergency fund is one of the smartest money moves you can make right now.

#2 – Pay Down High Rate Debt

Consumer debt is the largest obstacle you face when creating wealth. It comes with high-interest rates, which restricts your wallet and your freedom.

According to Creditcards.com, the typical rate on a credit card is over 16%! Use your extra $1,000 to pay down these debts and generate an immediate 16% risk-free return on your money.A

A guaranteed 16% return on your money is unheard of. I would take that every day of the week, month, and year! And did I mention it’s RISK-FREE?

#3 – Save It

The FDIC (Federal Deposit Insurance Corporation) publishes the average bank account yields. Currently, the average return on a savings account is just 0.06%! This is far below the inflation rate.

Make your money work harder for you. Look at current interest rates on Bankrate. Find a bank that offers both a high rate and sign up bonus. Then, transfer your money.

I like to keep my capital in high yield savings accounts. It grows while I research different investment opportunities or save for the down payment on my next investment property.

#4 – Grow Your Passive Income

Who doesn’t love receiving money for little to no work? Having an extra $1,000 is a great time to start growing your passive income.

Many people begin earning passive income from dividend-paying stocks. I did too and some of them I have held for decades. Once a quarter, the dividends get deposited into my account like clockwork!

You can elect to have your dividends reinvested, too. This allows your money to grow faster, which increases your yield!

Consider buying a REIT (Real Estate Investment Trust). They allow you to own real estate and enjoy the cash flow, refinance, and sale of the portfolio’s assets. All without getting the dreaded 2 AM clogged toilet phone call!

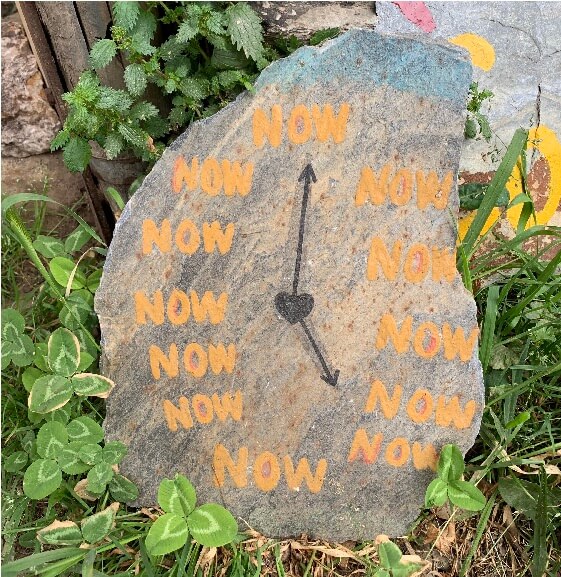

#5 – Think Long Term

Now is always the best time to start working towards your financial goals. The sooner you start, the longer compounding works for you, and the less you have to save.

Most employers offer a 401k and you can use the extra $1,000 to boost your retirement savings. Not only does it reduce your ordinary income, but your employer may match a part of your contribution, too.

This is free money! You put in a dollar, they put in a dollar. And you know what I call that? An instant 100% return on your money. Cha-ching!

Allocating extra money to max out your employer match is one of the best money moves you can make.

A Roth IRA is another tax-advantaged retirement vehicle. The contributions get made using your post-tax earnings. The capital grows tax-free and you don’t pay taxes on any of the gains either!

An extra $1,000 in your pocket makes it the perfect time to think about your children’s future, too. Start a 529 Plan for their education. The contributions grow tax-free. You won’t pay any taxes on the gains, as long as the money gets used to pay for college.

#6 – Start or Grow A Side Hustle

A recent survey shows that almost half of the American workforce is not satisfied with their jobs. If this describes you, it may be time to grow a side hustle.

Putting extra money towards projects outside of your 9-5 is one of my favorite money moves. Side hustles are a great way to gain experience, increase your income, and begin working towards financial freedom. They’re easy to start and you can use the skills you already have.

Are you an expert at getting cats to stop eating lizards? (Contact Me!) Or a computer genius? (Again, Contact Me!) No matter what your skills are, there is probably someone looking for your help. Use sites like Fiverr, Upwork, and Thumbtack to connect with the people that can benefit from your expertise.

Even if you love your job, it’s never too early to start working towards independence. Take the skills you enjoy from your job and grow your own business. Odds are that you won’t love your job and being told what to do forever!

These sites are a great way to test out your business ideas and post-retirement careers, too.

#7 – Invest In Yourself

One of the best investments you can ever make is in yourself. Develop your skills to become more marketable and valuable. Both of which can boost your income.

Use your extra cash to take a class. It doesn’t have to be employment or even financial related. All that matters is that you are educating and improving yourself in some new way, shape, or form.

Udemy and LinkedIn Learning offer 1,000s of classes on a wide variety of subjects. Many of them are less than $100!

Attending a seminar, reading a book, or a little self-care are great ways to invest in yourself, too.

#8 – Hire A Professional

If there is one thing I have learned over the years, it’s that I’m not handy. I have come to understand that I need to hire professionals. The good ones pay for themselves many times over, too.

Professionals have years of experience. They have developed their talent and know-how to get things done right.

You wouldn’t trust yourself to build your dream home. Instead, you would hire someone who does it every day. They spend 1,000s of hours every year perfecting their craft.

One of the best money moves you can make is to hire a CPA. Set up a meeting and learn about the different types of income. Then, create a plan to save money on one of your largest expenses, taxes.

Talking with a lawyer and planning ahead are a great use of extra money, too. No matter where you are in life, it’s worth creating or reviewing your will. They can work with your CPA and help with estate planning, too.

Are you ready to take your life to the next level? Consider hiring a coach. These individuals will help you break through barriers. They bring expert knowledge and experience to the table, which helps you reach your personal best and achieve your goals!

It’s impossible to be an expert in everything. Save yourself time and money by hiring a professional.

#9 – Experiences

Remember the times you spent playing games with family, vacationing with friends, and crossing items off your bucket list? Experiences are priceless.

There are many studies that have found spending money on experiences, instead of things, provides a better sense of well-being.

Sharing experiences with others helps you to connect with them. You are more likely to bond with someone who’s graduated from the same university, than someone who also owns a basketball.

Having experiences and doing new things helps you feel alive. They break your routine and take you out of your normal environment, allowing you to view the world differently.

Experiences are great because they create memories. And these memories can be relived over and over at no additional cost, making them Tightwad Todd approved!

Point 10 – Give It Away

There are plenty of problems in the world. Climate change, war, and plastic are just a few that come to mind.

Billions of people around the world are under-served. Many survive on a few dollars a day. Some suffer from malnourishment and disease, too.

Right here, in the United States, there are millions of people in need. Many face food insecurity, poor access to healthcare, and addiction.

All these people can benefit from a charitable gift. Even part of your $1,000 can have an enormous impact on another human being.

Find organizations that you relate to using Charity Navigator, Give.org, and Charity Watch. Then, give and know that you are making a difference in someone’s life.

Consider the words of Warren Buffet, “If you are in the luckiest one percent of humanity, you owe it to the rest of humanity to think about the other 99%.” And as US citizens, we are all fortunate.

There are many smart money moves to make with $1,000. Unfortunately, most people choose to blow it on more stuff they don’t need.

But you’re different. You realize the good your money can do. Decide to use it to make a difference in your life or the life of another.

Use this list, choose the best thing you can do with $1,000, then act. After all, your future gets determined from your ability and willingness to invest in today.

Which money moves are you going to make? Comment below.

Leave a Reply