If you’re like most busy professionals, your financial situation could be better. You may want to become debt-free, consistently be on budget, or start investing for retirement. No matter your goals, you first need to build money habits that will allow you to have a financial transformation!

Deep down, most people want to transform their finances and therefore their lives, but oftentimes they’re unable to. They may find that it’s difficult to make changes in the way they manage money. Whether they realize it or not, these old money habits are keeping them stuck in a less than ideal situation!

If you keep doing the same thing that you’ve always done, how do you expect to get different results than the ones you have now? Truth be told, you won’t. Your financial situation won’t improve and in some cases, it may even get worse!

However, building better habits with money will spark your financial transformation. By getting rid of the old ones and starting anew, you’ll have a framework to follow that will improve your financial position!

Here are 5 easy to follow money habits that will spark your financial transformation!

Money Habit #1: Thinking Before You Buy

Many people don’t realize it, but many of their decisions are deep-rooted, automatic, and routine. In fact, your subconscious and emotions play a large role not only in your day-to-day choices but also in the way you handle money!

For instance, if you experienced a traumatic event in the past, like going hungry or being food insecure, it would likely affect the way you manage money. To avoid those painful memories, you might overspend in your food budget category to ensure you never went hungry again.

Your emotions are powerful and oftentimes retailers use marketing gimmicks that manipulate them. They run ads that make you feel inadequate or like something is missing from your life. In response, you may spend emotionally or buy more goods than you should. As a result, you may bust your budget which can prevent you from living below your means!

Many consumers also make unconscious buying decisions. They get stuck in habitual spending patterns, many of which provide them with little to no benefit. Because of this, they end up wasting money!

To eliminate financial waste, get in the habit of thinking before you buy. You can start by asking yourself the following questions ahead of each purchase:

- Is this a need or want?

- Is there a cheaper or free alternative?

- Do I already have something similar?

- Would it be better to borrow or rent this item?

By having the forethought to ask these questions before buying, you can break habitable spending patterns. Instead of making rash decisions, you can take a step back and think them over. As you do, you may decide the purchase isn’t worth it. Even if you don’t, you’ll still be a more conscious consumer.

For some people, it may be difficult to ask these questions on every purchase. Another option would be to consider them on big-ticket items that are over a pre-set dollar amount.

Whichever option you choose, being aware of what you’re buying and in what amount can help to reign in your spending. As you do, you’ll begin to save and that can be the spark that ignites your financial transformation!

Money Habit #2: Tracking Your Spending

Many people who are successful with money give credit to their budget. It gives them a solid understanding of their income so they can develop a spending plan that allows them to save.

While a budget is helpful, it won’t help to improve your finances if you can’t stick to it. You can spend hours making the perfect budget, but if you don’t track your spending you’ll have no way of knowing whether you’re living within or well beyond your means!

Tracking your spending will help you have a financial transformation because it ensures you’re following your budget plan. Rather than straying off course, it helps you stay on track by monitoring each of your expense types. With this information, you can make adjustments to your spending so that you don’t go over budget.

When starting, review your spending every 1 or 2 days. In doing so, you won’t just see your spending history, you’ll also be able to reflect on whether the purchase was meaningful. If it wasn’t and you have regrets, then it likely wasn’t the best use of your money and you may want to cut or eliminate the cost when you can!

One easy way to track your spending is by using Personal Capital. In a matter of minutes, you can connect your accounts and have a complete picture of your spending history. Not only that, but it’s also a simple way to track your net worth as your financial transformation begins to take shape!

Money Habit #3: Monitoring Your Net Worth

In personal finance, there are a lot of important metrics. For example, there’s your burn rate, expected rate of return, and freedom number amongst many others. However, none of them are as important as your net worth!

Your net worth is the difference between your assets and liabilities. By calculating it, you’ll discover your financial health. While this can be helpful, the real magic happens as you begin tracking it!

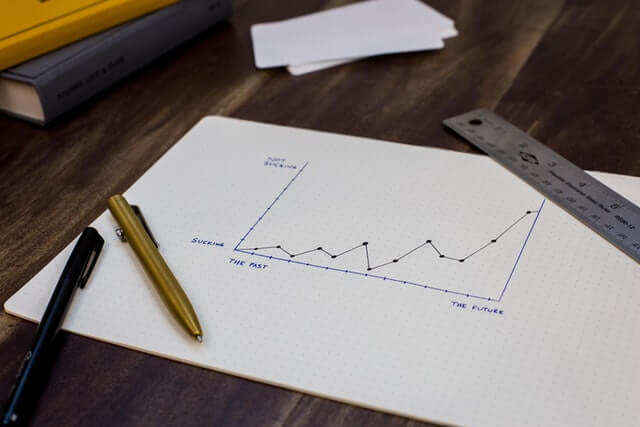

Much like your spending, tracking your net worth shows progression. It displays whether your money habits are hindering or helping you to create wealth!

For instance, if your net worth is trending down, it’s likely a sign that you’re spending more than you make or are buying liabilities. Whereas a rising net worth indicates that you’re accumulating wealth and moving closer to your dreams!

Monitoring your net worth also encourages you to maximize the value of every dollar you receive. Instead of buying frivolous status symbols and other material goods that subtract from your bottom line, you’ll be more likely to purchase assets that will add to it!

Money Habit #4: Paying Yourself First

For a large percentage of Americans, saving money is difficult. Given that it’s much easier and takes less financial discipline to spend, they’re often unable to save at all!

Most people realize that they need to save money. Yet, too many of them fail to do it!

In all honesty, the key to your financial transformation is saving money. With this habit, your financial situation will improve and it’s not a question of if, but of when!

The more money you can save, the faster you’ll begin to see changes in your finances. A high savings ratio allows you to put more money towards key milestones, like having a fully funded rainy day savings account or becoming debt-free!

Saving money is hard for many people because it’s an afterthought. But, when you pay yourself first, you make it a priority!

Paying yourself first means that a portion of your pay gets set aside before any of it gets spent. This way, you’re proactively putting money away towards your goals, rather than hoping you’ll be able to do it at a later date.

Many people that I work with find that it’s helpful to divide their savings into buckets, too. They may have one earmarked for different future expenses, such as a home purchase, retirement, or their child’s college education expense. Using a bucket approach allows them to keep their money separate as they track progress towards each goal. Otherwise, it can get complicated trying to keep track of the amount that’s allocated to each one.

An easy way to pay yourself first is by using financial automation. With it and your HR department’s help, a portion of your paycheck can automatically get transferred into your savings account. This way, you won’t wonder if you’re going to have enough money to be able to save, you’ll do it above all else!

Money Habit #5: Reflecting and Making Adjustments

When building new habits, it’s always a good idea to recognize what’s working as well as what’s not. In doing so, you can proceed with ones that are helping you move forward while adjusting or eliminating the ones that are holding you back!

For instance, a few weeks into your financial transformation you may realize that your budget is too tight and is unsustainable. You may need to cut some of your recurring costs and use the proceeds to pad other expenses to find some breathing room. Or you might find that adding a little more fun money gives you the psychological boost that you need to keep moving forward!

Regardless, to build new money habits and stick with them, you need to experiment and find out what works best for you!

After reading through this list, the money habits that will help you have a financial transformation are not rocket science. Rather they’re simple, straightforward, and most of them require little to no time investment at all!

Once you’ve built these new money habits, they’ll become second nature. As long as you can stick with them, it will be just a matter of time before your financial transformation is complete!

Which of these money habits do you need to build to have a financial transformation? Comment below.

Great list. I’ve found that all 5 of these things work well for my wife and I and have helped us to get to where we are today. I believe that tracking net worth alone can help get things on the right track in other areas, but also waiting a day before making a big purchase, and tracking spending closely help too. There can be a lot of runaway costs these days!

So true – keeping track of your finances helps you manage them better!