Whether you like it or not, life is filled with stressful events that can consume great amounts of energy and in extreme cases, rule your life. In these situations, regardless of if they’re financially related or not, there is a circle of control. Some aspects of the situation you can manage while others may be completely out of your hands!

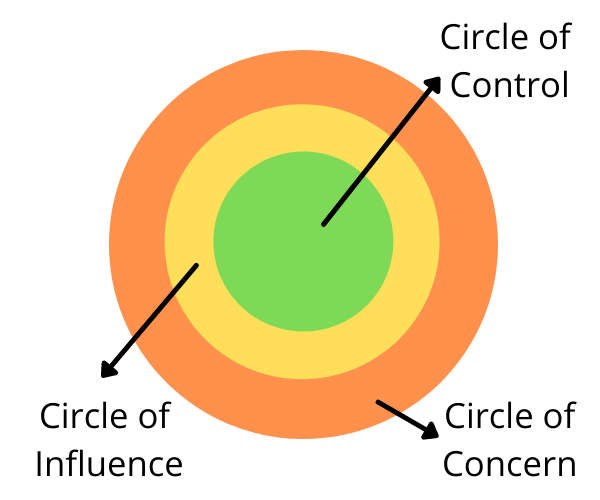

When it comes to personal finance and building wealth, you need to determine the factors you can control, those you can influence, and the ones you have no control over whatsoever! By understanding your circle of control, influence, and concern, you can focus your energy on the things you can change, instead of wasting it by stressing over the ones you can’t!

What is Your Circle of Control, Influence, and Concern?

When you take a financial assessment for the first time, it’s common to feel overwhelmed. You may experience this emotion because you believe that every aspect of personal finance falls within your circle of control!

For instance, if you’re financially insecure it’s likely due to living beyond your means, which is something you can control. Likewise, if you don’t have enough money saved for a financial goal, it’s likely due to spending too heavily. But what if not every outcome is your fault?

It’s important to realize that not all aspects of personal finance are within your circle of control. When you take a step back, you can see that they fall within 3 main categories:

- Circle of Control – What you can control

- Circle of Influence – What you can somewhat control

- Circle of Concern – What you can’t control at all

By determining your circle of control, influence, and concern you can figure out which parts of your financial plan you can control and which you can not. With this information, you can focus your efforts on the parts you can manage, allowing you to feel more empowered and less overwhelmed!

Factors Within Your Circle of Control

Most people experience some sort of money-related stress from time to time. Yet, many don’t realize they have the power to alleviate these feelings and experience better ones by improving their financial situation!

Here are some common financial factors within your circle of control:

Your Income

Whether you realize it or not, you have control over your income. You get to choose where you work, in addition to how well you perform. Also, it’s up to you to decide how many side hustles you’ll have as well as how dedicated you’ll be to them.

Regardless of if you need or want to make more money, there are countless ways that you can. You could invest in yourself, freelance, or drive for a company like Uber or Lyft. All these options are within your control and have the potential to boost your income. You just have to decide which ones will be the best use of your time!

Your Spending

No matter your money personality, almost everyone likes to spend their income one way or another. However, it’s important to realize that even people that have vast fortunes can not spend endlessly. If they did, they’d eventually run out of money and be left in the middle of a personal financial crisis!

You are in control of your spending since you get to choose how much you’ll pay for your major types of expenses like housing, transportation, and food. On top of that, it’s your choice how often you’ll treat yourself and to what extent.

Controlling your spending is not only crucial for building wealth, it’s necessary for keeping it, too. Think about all the professional athletes who had millions in the bank, yet had to file for bankruptcy because they didn’t have the financial discipline to control their spending!

Your Savings

Just like your monthly spending, you’re in control of the amount of money you save. You get to decide how often you’ll do it, the amount, and the account it goes into.

Even people who are currently living paycheck to paycheck can save money if they’ll create and follow a spending plan that allows them to save.

For example, once you start saving a few dollars a month, it begins to add up. As it does, you’ll see progress and be more willing to be frugal with money which allows you to gain additional momentum towards your financial goals!

When You Retire

One common money myth is that retirement happens at age 65 for most people. In reality, you can retire once you have enough money to sustain your lifestyle for decades to come!

The decisions you make about your income, spending, and savings all influence how quickly you can build independent wealth. Not only that, but they influence the amount of money you need to sustain your lifestyle once you’re in retirement, too.

What is Your Circle of Influence?

Now that you understand some of the factors in your circle of control, we can dive into your circle of influence. This circle contains factors that you have indirect control over.

Here are a few common factors in your circle of influence:

If You Keep Your Job

You have direct influence over how well you perform at work, but some other work-related factors are outside of your control. For example, you do not influence how the owner of the company chooses to run their business. They may run it into the ground or phase out the department you work in. Still, you need to work hard and gain skills while also realizing you don’t have full control of your job 100% of the time.

How Your Investments Perform

You can decide how much money you’ll invest and the amount of risk you’ll take, but you can’t control how well your investments will perform.

Before investing in an asset, you should be honest with yourself about your time horizon. More than likely it will take several years before you’re able to realize any sort of financial gain!

If You’ll Get Promoted

For many people, getting a promotion or finding a better-paying job is a dream come true. It’s often a way for them to earn and save more money. But, you can’t always control if and when you’ll receive a raise.

You can control the amount of effort you put into being the best in your department which will likely put you in a favorable position for receiving a raise. But, you can’t force someone to give one to you nor can you guarantee that a higher position will be available when you want it. Due to some factors being in your control and others not being in your control, promotions fall within your circle of influence.

What’s in Your Circle of Concern?

Despite the unnecessary stress that it causes, many people get hung up on the circle of concern. This circle contains elements of personal finance that you can’t control whatsoever!

Here are a few factors in your circle on concern:

State of the Economy

You can do everything right in personal finance, like having a high savings ratio, balancing risk vs reward, and investing consistently, but none of these factors have any bearing on which way the economy will move!

For example, consider the housing crisis and pandemic-related recession. During both of them, asset prices were in free fall and their recovery was completely outside of your control.

In events like these, the only control you have is over your reaction. You could either worry and stress yourself out over something you can’t control (which is pointless!) or you could strategize and find ways to capitalize on these unforeseen events!

State of the Markets

No matter whether you believe in efficient or inefficient markets, all financial markets are going to move independently of your views. Sometimes they’ll go the way you want them to and other times they won’t. Regardless, it doesn’t matter what you do, you have no control over them in the slightest!

Politics

There’s a good chance that we’d all be happy if politics didn’t affect us, but the truth is they do and they can have a tremendous impact on your finances, too. Political unrest, changes to regulation, as well as the tax code can all move financial markets in one direction or another and they’re all 100% outside of your control!

That doesn’t mean that you should ignore politics altogether. You still need to be informed so you can make financial related decisions based on the outcomes you believe are most likely to occur. But, you shouldn’t spend hours stressing over events that are in the circle of concern since in the end there is nothing you can do!

Putting it All Together

At first, it may sound a little crazy to take a step back and consider the aspects of your financial life that you can and can not control. However, realizing there is a difference allows you to devote more time and energy to the areas you can control, instead of wasting it on the ones you can’t!

You should concentrate the majority of your energy on the circle of control first, and then on your circle of influence. With these two factors under control or at peace in your mind, you can better handle the ones that you have no bearing on whatsoever.

Final Thoughts

How do you decide what’s in your circle of control? Think long and hard about the aspects of money that you can control and then pour your energy into them. Soon thereafter, you’ll begin to realize the difference it makes not only in your bank balance, but in your headspace as well!

What changes can you make in your financial circle of control to get faster results? Comment below.

Leave a Reply