You know the feeling that starts in the pit of your stomach? Then, it makes its way up to your throat? Soon thereafter, your heart begins racing and your palms start sweating?

These are the first signs of you realizing that you made a mistake. You bought something you shouldn’t have and buyer’s remorse is setting in.

Most people get excited before they buy a big ticket item. They’re eager to get home, put it to use, and see how their life will change for the better!

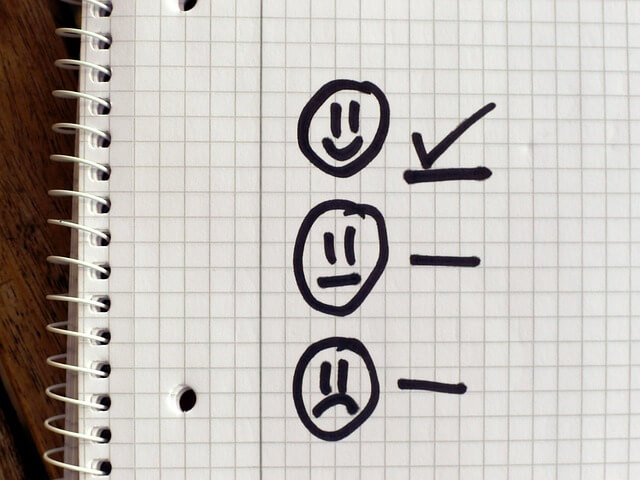

But, sometimes minutes after trying it out, their feelings change. The purchase isn’t as great as it seems or as good as they’ve been told. This leads them to experience feelings of disappointment, frustration, and regret.

You need a plan to avoid encountering these unpleasant emotions in the future. One that ensures you’ll still be happy long after you’ve purchased that big ticket item!

What Is A Big Ticket Item?

Is it $50, $100, or $1,000?

It can be. But it may be more or less than these amounts, too.

The price of a big ticket item is subjective. It depends on each individual, their budget, and how comfortable they are spending.

It may not be a big deal for someone who makes $200k to go out and spend $1,000 on an impulse item. But, for someone who earns a fraction of that amount it could be a big purchase.

The most common big ticket items are associated with your top expenses. These 4 items make up over 60% of your spending. They include your housing, tax, transportation, and food costs.

Many people don’t realize that overspending in these areas, affects other aspects of their life, too. If you spend extravagantly in one category, then you’ll have less to spend in others.

For example, imagine you’re shopping for a new home and you find “The One.” You’re in love with the beautiful kitchen, open floor plan, and spacious backyard. It’s over your budget, but you have to have it. So, you splurge and get your mortgage approved at a 55% debt to income ratio. This means 55% of your pre-tax income will go to your home and debt payments.

But, this ratio doesn’t account for your taxes, food, or transportation costs. Adding these in brings your total expense ratio close to 90%! Forget about taking a vacation, retiring early, and most everything else. You’ve handcuffed yourself to your job and need it to pay bills and survive!

This situation is more common than you think. Many people have good intentions and start with planning for a big ticket item. Then, their emotions take over and their budget goes out the window!

How Most People Buy a Big Ticket Item

Marketers use tactics like; “For A Limited Time,” “Today Only,” and “They’re Almost Gone” to create FOMO (fear of missing out). And fear is a powerful emotion that causes most people to make rash decisions.

Often, people rush into purchasing a big ticket item which causes them to overpay, too. They haven’t planned or created a reserve fund for it. So, they go into debt and end up making payments on the purchase long after the excitement has worn off!

How You Should Purchase A Big Ticket Item

Some purchases turn out to be a waste of time and money. They don’t perform the way they claim which leaves you feeling regret.

But, you can avoid this pain by asking yourself the 10 questions below before you buy. They’ll ensure that your big ticket item is meaningful, brings you joy, and gets purchased worry-free!

#1: Do you need the item right now?

Consider if this item is a need vs want. A need is necessary for your survival while a want would be nice to have. Needs are more urgent purchases than wants. Determine how pressing the purchase is, then proceed to the next question.

#2: When does the product go on sale? Can you wait till then?

Many items that we want appear as needs because of the tricks marketers play on us. But, most of these purchases can wait. Review your money calendar for upcoming deals and plan to buy these items on sale!

#3: How often will you use the big ticket item?

In most cases, it makes sense to buy products that you’ll use often. But, that doesn’t mean you have to buy new. Consider buying used too. Look at websites like Craigslist, eBay, and Facebook Marketplace.

See if you can rent or borrow the items that you’ll seldom use. Try sites like Rent Items and RentNotBuy.com. Consider borrowing them from family, friends, and neighbors, too.

#4: Have you researched the product?

Take a look at the reviews and experiences that others have had with this big ticket item. You may find there’s another product or manufacturer that can better meet your needs.

#5: Does the purchase have additional costs?

Often, a big ticket item comes with hidden costs. There may be expenses for using, maintaining, or storing your new purchase.

For example, imagine you have enough money to buy a boat. Once you’ve made the purchase you’ll need insurance, gas, and a place to store it. And don’t forget about maintenance costs, too! These expenses can add up fast, derail your budget, and leave you feeling frustrated.

Make sure you understand how the entire purchase will impact you. Consider your savings ratio, lifestyle, and financial goals before you buy.

#6: Are you getting the best price?

The name of this site is Tightwad Todd, so this one should be a no-brainer! Shop around until you know for certain that you are getting a great deal.

#7: Do you have the cash to buy it?

If you have to go into debt to buy a big ticket item, then you can’t afford it. Even if the monthly payments will fit into your budget.

Paying cash means that you’ll own the item outright. You won’t get stuck paying interest or fighting against the power of compounding for years to come!

#8: Can you save for the purchase?

Working and saving up for a big ticket item proves to yourself that you really want it. You’ll even experience greater joy from the effort you put in to get it!

Start by creating a monthly savings goal and adding it to your budget. Then, use financial automation to have the money transferred to your reserve fund.

#9: Does this item align with your top priorities?

A foolproof way to feel upset about a purchase is spending on something that doesn’t matter to you in the first place. This all but guarantees you’ll have buyer’s remorse and be wasting money in the process!

Instead, prioritize your spending. Buy things according to your priorities and values. These are the areas that will bring you the most joy.

#10: How long can you wait?

Delaying a purchase and still wanting it, confirms that it’s meaningful to you. This item will bring value and happiness into your life.

For the less expensive items you want to buy, try waiting 24 to 48 hours before you purchase them. And when it comes to an extra-large big ticket item, prolong the purchase for weeks or a month to see if your desire fades.

Many times you’ll find that once you’ve saved and thought about the item, you no longer want it either!

Most people experience regret when they make poor financial decisions. They get caught up in the thrill and excitement of the buy, only to realize later it wasn’t the best use of their money.

You shouldn’t purchase a big ticket item on a whim. Instead, give yourself time and ask these questions to ensure the product brings you as much joy as it claims that it will!

Which big ticket item has brought you the most happiness? Comment below.

I am looking at an original painting by an artist I love. I have a wall that has artwork I am tired of and want to get rid of. So, since I will have an empty wall soon, I think this painting is a need. What say you?

This is something that you want. Remember needs are something you need to sustain life and wants are more comfort purchases.