Throughout the world, Americans are known as consumers. We make up just 5% of Earth’s population, yet we consume a third of the world’s paper and almost a quarter of the world’s oil. All this spending and consumption affects our ability to save.

Americans are getting worse at putting money away, too. For decades, the US savings ratio has been in decline. Back in the 1960s, Americans saved over 10% of their incomes. Today, most people save less than half that amount!

We’re living longer as technology and medicine advance. This means we’ll require more money to meet our ongoing financial needs. Otherwise, we risk trading a happy retirement for one of financial hardship.

Increasing your savings rate is the key to securing your financial future. It helps ensure you’re living below your means today and preparing for tomorrow.

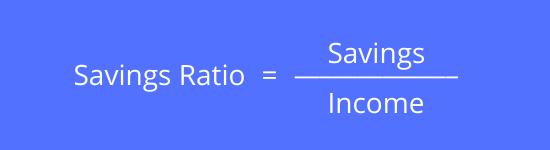

What Is A Savings Ratio?

Saving money is a choice. It’s a decision that you make, which impacts your future.

A savings ratio (or savings rate) is the percentage of your income that you save every month. It measures the portion of your money that’s getting put away for use at a later date.

The higher your savings rate, the more money you accumulate. This results in extra cash to put towards your emergency fund, debt, and other financial goals.

Your savings ratio helps project your future financial situation, too. It gauges whether you’re putting away enough money to make your dreams a reality!

What Determines Your Savings Rate?

Three things influence the rate that you accumulate money. There are economic, social, and individual factors.

Most people’s economic state affects their ability to save the most. Low-income earners spend the majority of their resources to meet their financial needs. This leaves them with little leftover. While higher-wage earners can meet their needs more easily, which gives them a greater opportunity to save. But, whether they do or not is another story!

Economic cycles also influence savings ratios. During financial crises and times of uncertainty, people are more likely to save because they’re unsure of what the future holds.

This holds true for COVID-19, too. An article on Next Advisor, shows that American’s saved more than ever before during the first half of 2020!

But, positive economic news has the opposite effect. It diminishes people’s fear, which leads them back to the stores and their old spending habits

Our ability to save stems from individual factors, too. Our unique money mindset, values, and morals contribute to the way we budget and consume.

Lifestyle creep also impacts your savings ratio. Most people are more likely to buy things when they see their friends, co-workers, and neighbors doing the same.

Far too often, people purchase goods they don’t need to keep up with the Joneses. Sometimes, they spend more than they should and take on debt. This can handcuff them to a job and limit the choices they’re able to make!

Your budget and spending habits are a direct reflection of your priorities. Needlessly spending and consuming today puts a greater emphasis on here and now. While choosing to save gives more weight to the future.

Time Preference

The degree to which you prefer to consume now versus in the future is known as your time preference. The more willing you are to consume today, the higher your time preference. You value time more now than at a later date. So, you spend today, which lowers your savings ratio.

But, some individuals (like tightwads) tend to focus more on the future. These people delay gratification, which lowers their time preference and increases their savings rate.

Why Is Your Savings Ratio Important?

Your savings rate has one of the largest impacts on your financial success. It determines the amount of money you have available to grow and compound.

For example, imagine you make $60k per year and save $500 per month. If you increase your savings ratio from 10% to 11%, you would save $50 more per month. Investing this amount every month for the next 30 years at 8% adds $69,969 to your nest egg!

Your savings ratio also influences your burn rate. This is the portion of your money that gets spent every month. Putting more money aside means there’s less available to buy things. This ensures that you’re living below your means, saving, and creating wealth!

How To Increase Your Savings Ratio

When you boost your savings rate, you’re accumulating money faster than before. This means you’re progressing towards your financial goals more rapidly, too!

Your monthly budget is made up of your income, spending, and savings. These components are connected and changes in one affects the others.

Your savings rate is a function of your expenses and income. Decreasing your spending or increasing your income, both result in a higher savings ratio. But, when you do both you’ll experience the best results!

You can start making changes in your buying habits right now. Consider your needs vs wants and prioritize your spending based on the things that bring you the most happiness. Then, reduce and eliminate the ones that don’t. This keeps more money in your pocket and boosts your savings rate!

Also, think of ways you can increase your income. Consider talking to your boss about a raise, switching employers, or starting a side hustle. All these can help you make and save more money!

Unfortunately, many people are hesitant to increase their savings rate. They believe that saving more money will have a negative effect on their lifestyle.

But, it’s not true. For most people, increasing your savings ratio by a percent or two translates to $100 per month. Decreasing your spending by this amount is hardly noticeable and has huge financial benefits over time.

My clients don’t talk about feeling a financial pinch when they decide to spend less. Instead, they comment on their excitement, progress, and increased sense of financial wellbeing!

A great time to increase your savings ratio is with pay raises. Timing these two events together helps prevent you from feeling like you’re missing out or skimping on your spending.

Lots of people struggle to save because they budget backward. They earn, spend, and then save what’s leftover.

Instead, pay yourself first. Automate your savings so that you earn, save, and then spend. This method puts you on track to meet your savings goal first. So that you aren’t struggling to find the money at the end of the month.

More Tips To Boost Your Savings Ratio

- Payoff debt

- Reduce your top expenses

- Have a plan for financial windfalls

- Manage lifestyle creep

- Find free money

Your savings ratio is a key metric. It shows the rate that you’re accumulating money and your commitment to your future.

But, stashing money away is only half the battle of wealth creation. The other is putting this capital to work so that it’ll earn a good return and grow.

The risk of not saving and investing enough far outweigh the risk of saving and investing too much.

Commit to increasing your savings rate. Your future self will be grateful that you did!

What’s your savings ratio? Comment below.

Leave a Reply