It’s that dreaded B-word again. No, not another birthday. I am talking about budgets. They are one of the most basic yet useful personal finance tools that exist!

A budget gives you control over your money and a plan for achieving your financial dreams. They provide a framework for directing your money to the things that are most important to you. Many people fail to save and invest because there is not any money left at the end of the month. They don’t know how much they spend or where their money goes.

Budgets keep you organized and focused on your money.

There are four main budgeting techniques for achieving your financial goals. I will not force you into a particular budget, you are free to pick from the options below!

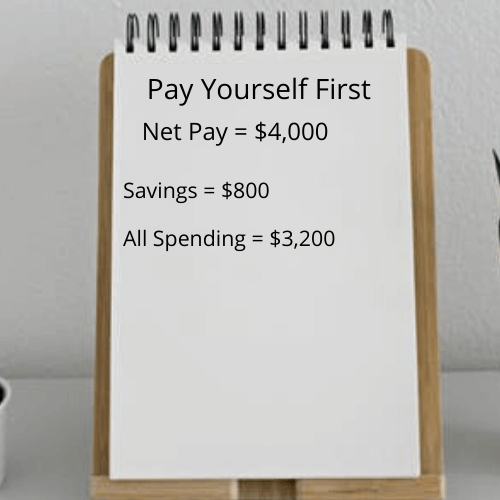

System 1: Pay Yourself First Budget

This is the easiest budgeting technique out there. You simply decide how much you want to save each month and set it aside. First, contact your employer and have your paycheck deposited into two separate accounts. Have your check split based on your goals into a savings account for your intended savings and into a spending account.

As the names imply, you save the money in your savings and spend the money in your spending account. You can spend all the money in the spending account if you like and drain it to zero each pay period. Just don’t touch the savings account!

This method allows you to easily set some very aggressive goals, however, it does take discipline. Need to save $8,000 in 10 months? All you need to do is transfer $800 a month to your savings account to get there, easy!

Here is a good visual for the Pay Yourself First budget system.

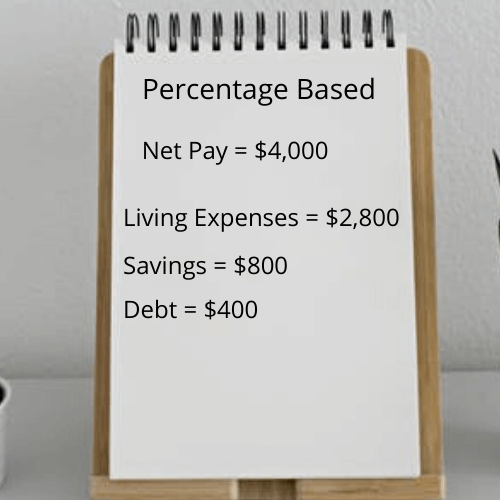

System 2: The Percentage Based Budget

This strategy requires slightly more work than the first but is still highly effective. Start with your net or take-home pay. Now take a percentage of this income and separate it into the following categories:

- Living Expenses – 70%

- Savings – 20%

- Debt payments and principal paydown – 10%

Using the same income as the first method, the Percentage Based budget approach looks like this:

This information shows how much money to allocate to each category every month. I suggest starting with saving a minimum of 20% of your monthly take-home pay. As you reduce and pay off debt, you can add that amount to the savings section.

You may find your debt payments are higher than what is allocated for this section. You will need to adjust the percentages. Since you have already been living above your means and spending money you don’t have, it is time to pay the piper.

Reduce the percentage that you allot for your living expenses, giving you enough money to cover your debt payments and to pay down the principal every month. Remember your goals and what you are working towards.

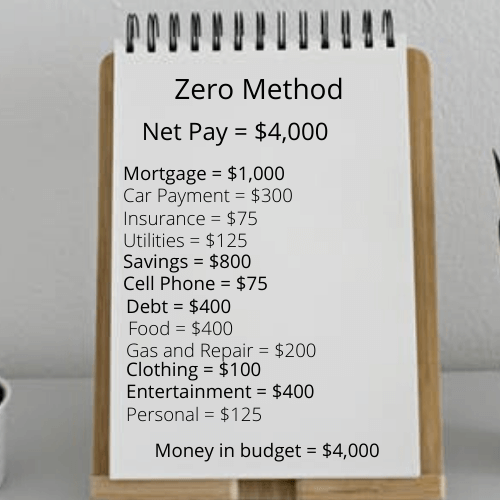

System 3: The Zero Budget

This is my favorite method of the group because you direct where every dollar goes each month. It’s efficient. Every dollar that comes in has a job to do. In essence, you are controlling your money, it’s NOT controlling you.

It takes a little bit of time to set up but your wallet will be grateful for it. Start by listing out your fixed expenses and corresponding dollar amounts. These payments are usually fixed amounts and don’t fluctuate much. Then do the same for your variable expenses, those that tend to vary from month to month. Some examples of each are:

Fixed Expenses

- Rent or mortgage payments

- Vehicle payments

- Insurance

- Utility payments

- Cell phone

- Gifts to charity

- Savings

Variable Expenses:

- Vehicle maintenance

- Food

- Clothing

- Gifts

- Fun/Entertainment

- Travel

- Personal items

Add your monthly savings goal directly into your budget as a fixed expense. It is now a part of your plan and won’t be something that gets overlooked.

The Zero Method is so aptly named because at the end of the month, zero dollars are left over. Each dollar that comes in is accounted for and has a job to do. The Zero Method looks like this:

System 4: The Envelope Budget

This is the most time consuming of all the techniques. However, if sticking to your budget is a real challenge, this one will work.

The Envelope Technique is similar to the Zero Technique, with one difference: This is a cash-only budget. First, you will need to go to the bank and take out cash in the amount of your take home pay. Next, take an envelope and label each one with an expense. Then, stick your monthly allotment of cash for each category into the corresponding envelope.

As you progress through the month and expenses come along, simply use the money in that particular envelope for the corresponding bill. Once a particular envelope is out of money, then you are not to spend any more on that category. Don’t even think about pulling money from any other envelope either. You will only be cheating yourself and your financial future.

At the end of the month, take out all of the cash in your envelopes and deposit it in your savings account. You may even find that you are saving more than your goal amount!

Here is a good visual for the Envelope Method:

This is the perfect method for people who do not like using debit or credit cards. It is a great option to help you stick to your monthly allotment in each category. The main downside is that many people may not feel comfortable having this much cash lying around their home. If this is you, consider leaving your savings goal amount in the bank and only withdrawing the money you need to spend.

Also, the envelope method isn’t very convenient. Running around town to pay your bills in cash or mailing in a cash payment is not something I recommend. Instead, set your fixed expenses up on auto payment and subtract them out from the amount of cash that you withdraw. Use the envelope system primarily for paying your variable expenses in cash.

Saving money is hard. It’s even harder without a plan. A budget lays out the road map for achieving your financial goals.

In the world of personal finance, there is no one size fits all money solution. Different techniques work for different people, and the truth is they all work. Choose your favorite method, set it up, and stick to it.

Which strategy will you choose? Comment below.

Well , I learned a lot. How to calculate my burn rate was interesting and showed me I need to spend some money on lunch with YOU.

Thanks Chuck! And yes I would agree that adding a line item into your budget for “Lunch with Todd” is a great idea!