Why are most financial professionals only interested in stocks, bonds, and insurance products? If they are truly advising on financial matters, shouldn’t they know about all the options that exist? Why is it that most rarely mention real estate?. Oh yeah, that’s right, they have no way of making any money on this advice, since most are NOT real estate agents.

So, why should you consider investing in real estate?

It is no coincidence that over 90% of the world’s millionaires created their wealth using real estate. It is one of my favorite investment types and there are many benefits to owning property. Having said that, here four of the best reasons to buy real estate today.

Reason #1: Cash Flow

When real estate is purchased properly, it pays you monthly. Cash flow is the monthly difference between the rent you collect and the expenses you pay on a piece of property. This income is fairly stable, since you typically know how much comes in and goes out each month.

Positive cash flow occurs when the monthly rent is greater than the expenses. If you own enough properties, you can generate enough cash flow to live on! I like to use my monthly cash flow to pay my personal bills or use the power of compounding interest to save for the next investment opportunity.

Reason #2: Principal Reduction

Most mortgages amortize, which is the gradual process of paying off a property. Mortgage payments are composed of a principal and an interest component. When you make a payment, a little goes towards the principal balance, while the majority goes to interest. As you make more payments, more money slowly goes towards principal and less towards interest. With each payment you make, the balance gets reduced at a faster rate.

The great part about investment property is that your resident pays the mortgage for you! I have a property where the resident has lived for over 5 years (knock on wood). Not only have I made substantial money from the cash flow, but they have also significantly paid down my mortgage!

Over time, this creates equity, the difference between the current market value and the amount owed on a piece of real estate. As your equity grows, you have the opportunity to do a cash out refinance, with the proceeds being 100% tax free!

Reason #3: Tax Advantages

Disclaimer: I am not a CPA. The information contained on this website is for informational purposes only and is not actual accounting advice. Be sure to contact your accountant before you take any action.

Now that that’s out of the way, let’s dive in! Taxes are most people’s second largest expense. Your wallet will appreciate anything you can do to reduce your tax liability.

The largest tax savings in real estate comes from depreciation, which is the reduction in the value of an asset over time due to its wear and tear. The IRS allows residential property to be depreciated over a 27.5-year schedule. This alone is one of the best reasons to buy real estate!

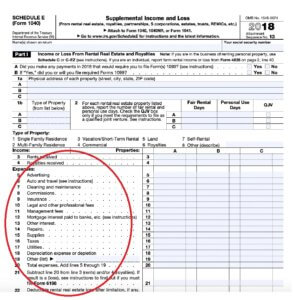

Depreciation is a line item on the Schedule E of your Tax Return and is used to reduce your taxable income. It is just a paper loss you can take each year until the property is fully depreciated. Keep in mind that depreciation only applies to the value of the building and not the land.

For example, let’s assume the value of a building on a piece of property is $100,000. If we divide this by 27.5, we end up with $3,636. Essentially, you can make $3,636 on a property, use the $3,636 paper loss of depreciation, and end up with a $0 tax liability!

The IRS allows other expenses to reduce our taxes too! You can write off items like mortgage interest, property insurance, and property tax. Sometimes, after all of these deductions and write offs, you end up with a loss. Currently, the IRS allows for up to $25,000 in losses to be applied to other types of income!

Take a look at the Schedule E from the Tax Return and notice all the line items that can be used to reduce your rental income.

A few more tax benefits are:

- Typically do NOT pay Social Security or Medicare Taxes

- Properties held long-term (over 365 days) are taxed based on long-term capital gain rates

- 1031 Exchange – allows for taxes to be deferred to a later date upon the sale (consult an expert)

Reason #4: Leverage

In the real estate world, the lender is your biggest partner. Most lenders will finance an investment property with only 20-25% of the purchase price as a down payment. The lender will supply the remaining 75-80%!

Banks love real estate. I don’t know of another asset class they are so willing to lend on. Even in the world of Wall Street, you would be lucky to get a loan on 50% of your stock portfolio.

Banks realize investment property is a stable asset class. Yes, there are the occasional downturns, just like in any market cycle, but it tends to occur slowly. It takes time for property values to change; it doesn’t happen daily like in stocks.

Think of the real estate market as a giant ocean liner. It takes a lot of time for it to slow down, change direction, and eventually turn. Stocks are more like the speedboat of the investment world, able to turn on a dime.

I could go on and on about my love and the best reasons to buy real estate. It provides great stability from cash flow and unmatched tax benefits. It also gives you control. The decisions you make will directly affect its performance, value, and ultimately your return on investment.

What’s your favorite investment? Comment below.

Leave a Reply